Rythu runa mafi AP – Andhra pradesh third part checklist and mortgage standing has coated on this article in case when you have no thought methods to obtain and examine the checklist, mortgage standing you’ll be able to test it out right here.

Within the Yr 2014, when Nara Chandrababu Naidu’s authorities got here into energy, AP Raithu Runa Mafi scheme has been launched. This AP Rythu Runa Mafi was launched into the third part of the mortgage checklist.

The Scheme was launched into the Mortgage Listing on ninth October at apcbs.ap.gov.in. Virtually three phases are launched into this scheme on yearly. The discharge particulars of the third phases of this scheme are shared under.

- The primary part of the scheme was launched in eleventh December 2014.

- The second part of the scheme was launched on twenty seventh March 2015.

- Ultimately, the third part was launched final yr on ninth October 2017.

However the speciality of the Third part is that it was introduced by our Honourable Cheif minister of Andhra Pradesh, Nara Chandrababu Naidu.

Extra and Extra particulars of this Scheme can be found in above-mentioned authorities web site and likewise by going via this entire article.

The Rythu Runa Mafi Scheme was launched solely for all of the farmers within the Andhra Pradesh State. By the top of this text, you’ll get to know in regards to the following aims that are additional defined with extra particulars.

- Key Options of the Scheme.

- Eligibility Standards for the Farmers.

- Verify Ap Rythu Runa Mafi Listing.

- AP Rythu Runa Mafi Standing or AP Mortgage Waiver Standing.

The knowledge on this article is gathered from the sources that are formally introduced by the Andhra Pradesh(AP) Authorities via media or via its official Web site.

The web site particulars are additionally talked about above with a hyperlink.

Verify AP Rythu Runa Mafi Listing On-line

AP rythu runa mafi checklist 2017 from third part on-line has been shared under.

Properly, among the districts from the checklist are Guntur, Chittoor, Kadapa, East Godavari, West Godavari, Anantapur, Krishna, Vizianagaram, Kurnool, Visakhapatnam, Nellore, Srikakulam and Prakasam.

In case you observe the under factors you’ll be able to simply examine the checklist of the AP Farmer Mortgage Waiver Listing on-line. The checklist you’ll be able to examine is that of the third part as it’s the newest part launched into the scheme.

- Go to the Andhra Pradesh Authorities Web site portal https://apcbsportal.ap.gov.in.

- You can be redirected to a Homepage of the Web site.

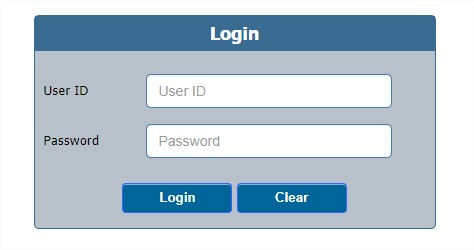

- Login to your Account utilizing the Login credentials.

- Click on one of many two choices from “Having an Aadhaar card” and “Account quantity”.

- Now choose the Financial institution you may have an account in and likewise department code on the Homepage.

- After that Enter the Account variety of your Mortgage Scheme.

- Ultimately, Click on on the “Submit” button on the backside of the web page.

After clicking on “Submit” button, you’ll be proven a listing of the AP Rythu.

Runa Mafi Listing in your display screen. You may examine the checklist and might discover your Account quantity within the checklist to know if you’re chosen for the checklist or not.

Solely the above-listed Districts are being thought of underneath the brand new third part of the Scheme. The remainder of the districts will probably be listed within the coming phases/years.

Undergo the process as defined to examine your account quantity within the launched checklist of AP Raithu Runa Mafi. The principle level is that the account quantity you enter will probably be of 15 Digit.

AP Mortgage Standing

The AP Mortgage Standing will be simply checked on-line when you observe the process which is defined under within the type of Steps. Go step-by-step to examine your AP Mortgage Standing.

- Go to the web site with the above-mentioned hyperlink.

- In any other case Click on right here https://164.100.132.115/loanstatus/ to instantly go to the Debt reduction web page.

- You can see choices like Ration Card, Aadhaar card and Mortgage Account quantity on the web page.

- Choose one of many choices and enter the respective doc’s quantity within the textual content column.

- Enter the Captcha for verification.

- Submit all of the Particulars and click on on “Verify Standing” to examine your AP mortgage Standing.

You can be redirected to the web page as proven above the place it’s important to observe the above-mentioned process. Watch out whereas coming into the small print and in the course of the collection of choices from the checklist. That is how it’s important to examine the AP Mortgage Standing on-line.

Eligibility Standards

This Scheme is strictly and solely for the Farmers within the Andhra Pradesh State which was launched by the State Authorities itself. You need to be eligible to get into the checklist of the AP Rythu Runa Mafi of the third part.

- The applicant ought to be a farmer and likewise have to be a citizen/domicile of Andhra Pradesh.

- The Applicant Ration card have to be issued within the Andhra Pradesh State solely.

- Not all Farmers will get the advantages of the Scheme.

- Farmers who’ve taken mortgage earlier than 2014 will probably be eligible for the scheme.

- This Scheme is for medium and small farmers. So no wealthy farmer will probably be eligible.

You may apply for the AP Rythu Runa Mafi Scheme if the applicant is eligible to all of those factors talked about above within the Standards. He/She ought to be relevant to each level to get the advantages of the scheme.

Key Options of the Scheme

On this Key options, we’re wanted to know in regards to the Goal of the Scheme, Funds, Curiosity Price underneath this scheme, and all of the phases that are included within the Scheme. Observe all the key options of the AP Rythu Runa Mafi Scheme.

- The principle goal of the scheme is to waive off the heavy mortgage burden carrying by a Farmer.

- Via this scheme, the mortgage quantity of selective farmers will probably be decreased by reducing down the mortgage quantity.

- Eligible farmers must pay some portion of the mortgage whereas the remainder of the portion is paid by State Authorities.

- Beneath this Scheme, roughly Rs.3600 Crores will probably be paid by the Authorities.

- Eligible farmers will get rest in rates of interest and levied on the mortgage quantity as effectively.

For starters, this AP Farmer Mortgage Waiver Scheme is launched Part by Part. Its like, when one part is a whole success then the consecutive part will get began. As talked about above all of the Three phases are already launched and began by the Authorities.

How To Apply for AP Rythu Runa Mafi

Observe the process rigorously as a way to have the ability to apply for the Scheme.

However earlier than that, undergo the Eligibility standards as a way to know if you may get the advantages of the scheme or not earlier than you’ll be able to even apply for it.

- Register with the official web site of the Scheme by the above-mentioned hyperlink.

- After registering efficiently you’ll be given a Login ID and password.

- Login to the web site utilizing these credentials and get the appliance kind.

- Fill in all of the required particulars and submit the appliance kind.

That is a lot of a Transient model of Learn how to Apply for the scheme, So watch out when you are filling the appliance kind or when you are registering for an account on the official web site.